Rush Announces Nearly $197 Million Delivered in Tax Cuts to Seventy Nine Thousand Families in Illinois’ 1st Congressional District

![]()

Rush Announces Nearly $197 Million Delivered in Tax Cuts to Seventy Nine Thousand Families in Illinois’ 1st Congressional District (Washington) — Today, U.S. Representative Bobby L. Rush (D-Ill.) announced that, with the final payment going out on December 15, the expanded monthly Child Tax Credit will have delivered a total of nearly $197 million in tax cuts to more than 79,000 families in Illinois’s 1st District in 2021. Rush voted for the expanded monthly Child Tax Credit (CTC) as part of the American Rescue Plan, which was signed into law by President Biden in March.

Statewide, an estimated $3.45 billion in tax cuts will have been delivered by the end of the year to more than 1.3 million Illinois families as a result of the expanded Child Tax Credit. Nationwide, 90 percent of families with kids — more than 36 million American families — received monthly Child Tax Credit tax cuts this year. The House-passed Build Back Better Act, which Rep. Rush helped write, would extend the expanded CTC for another year.

Congressman Rush’s Vote

“My vote for Child Tax Credit as part of the American Rescue Plan was one of the proudest votes I have ever taken during my time in Congress,” said Rush. “The expanded monthly Child Tax Credit is the greatest American anti-poverty program of the last 50 years, and it has led to meaningful declines in child hunger and child poverty in the 1st District and across our nation.”

“America is the richest country in the world, and yet, far too many of our children are living in poverty,” Rush continued. “I was raised in a single-parent household, and growing up, I remember times when all there was to eat in the pantry was bread and syrup. The Child Tax Credit would have helped my mother put food on the table, and I am delighted and grateful that it has helped more than 79,000 families in the 1st District afford food, clothing, school supplies, and other essential items. We cannot let a tax cut this impactful and important expire. We must extend it by getting the Build Back Better Act signed into law.”

The American Rescue Plan expanded the Child Tax Credit to up to $3,600 per child for children ages 0 to 5, and $3,000 per child for children ages 6 to 17, one of the largest-ever single-year tax cuts for families with children. The American Rescue Plan also authorized advance monthly payments of that tax cut beginning in July and running through December 2021, allowing families to receive up to $300 a month per child for children ages 0 to 5 or $250 a month per child for children ages 6 to 17 each month. Families will receive their remaining expanded Child Tax Credit when they file their 2021 tax return. Because the CTC was made fully refundable, previously ineligible low-income families have been able to receive the full credit.

Rush Joins FamiliesI

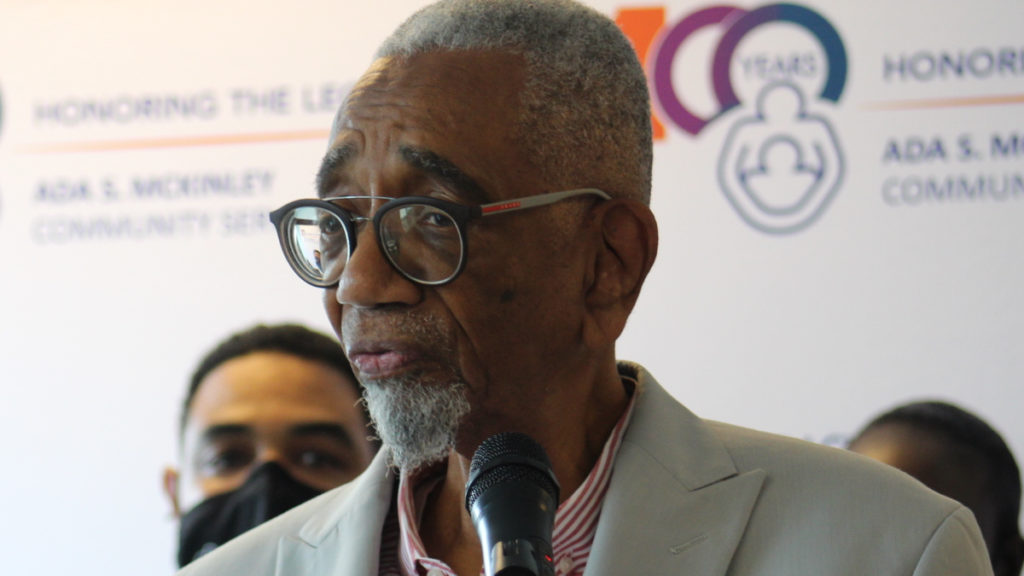

In July, Rep. Rush joined families and representatives from Ada S. McKinley Community Services in the 1st District for a press conference highlighting the impact of the Child Tax Credit. Photos from that event are available here:

https://drive.google.com/drive/folders/1t2s1-W1_Q-nCyuCUcgngVPjaBG0CzJbK?usp=sharing.

A fact sheet on Child Tax Credit payments in the State of Illinois is available HERE.

Information about the impact of the Child Tax Credit from the Joint Economic Committee is available HERE.

More information about the Child Tax Credit is available at ChildTaxCredit.gov.

Rush Announces Nearly $197 Million Delivered in Tax Cuts to Seventy Nine Thousand Families in Illinois’ 1st Congressional District

Responses